Pru Life UK leads talks on mHealth transformation through Healthscape PH webinar

Leading life insurer Pru Life UK today launched the latest addition of its PRUWise Webinar series called ‘Healthscape PH’, a timely and insightful dialogue among key stakeholders from the Philippine healthcare sector, attended virtually by about 1,000 participants.

Titled “Healthscape PH: Harnessing the Power of AI and Mobile Health in Transforming PH Healthcare,” the first webinar of this series discussed topics on mobile digital health (or mHealth), challenges post-COVID-19, and the behavioral shift towards digital healthcare, as well as highlighted the role of public and private institutions in advancing mHealth in the country. The panelists comprised representatives from Pru Life UK and its regional headquarters Prudential Corporation Asia, as well as industry partners from Babylon, a global healthcare organisation with a growing strong presence in Asia, the Department of Health (DOH) and leading telecommunications conglomerate PLDT Group.

“We are pleased to hold the first Healthscape PH webinar along with our partners to discuss digital health as part of our ongoing advocacy of supporting Filipinos’ wellbeing through innovation. We believe there is a strong opportunity to leverage mobile health technologies to help promote more accessible and affordable healthcare in the Philippines,” Pru Life UK President and Chief Executive Officer Antonio “Jumbing” De Rosas said.

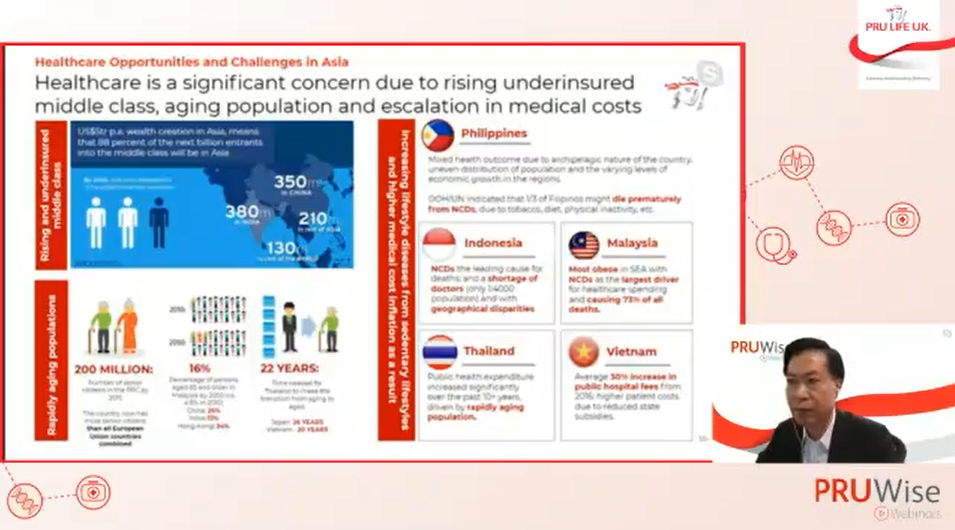

At the webinar, Prudential Corporation Asia Chief Health Officer Andrew Wong expounded on Prudential’s ambition for digital health and shared how the company is playing a more extensive preventive role alongside protection to address the growing health burden in Asia. Babylon’s Chief Medical Officer, Dr. Mobasher Butt, complemented the discussion by explaining what makes their technology the world’s first integrated medical AI platform and shared global examples of how healthcare systems can be transformed through a digital first healthcare delivery model. He also shared his views on how AI can help address issues in the accessibility and affordability of healthcare services in the Philippines.

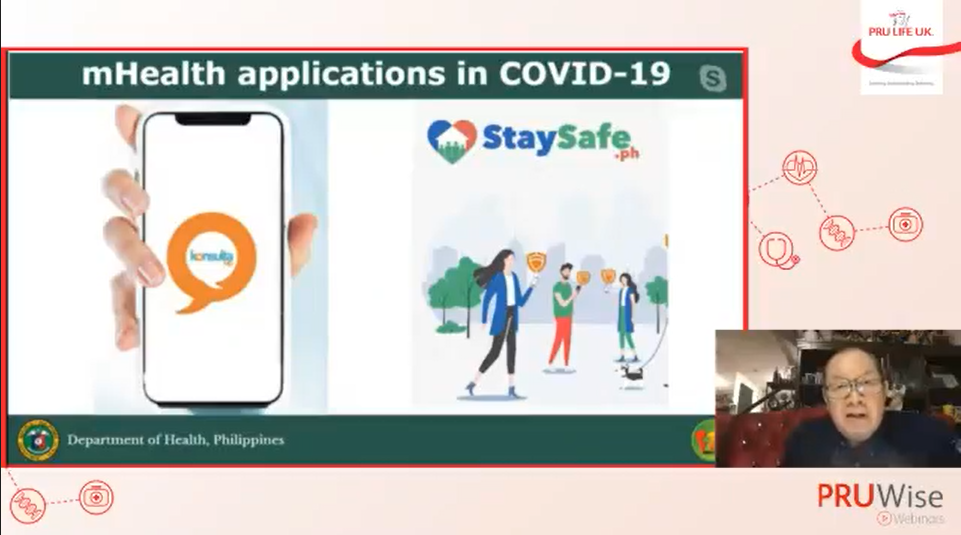

Other key stakeholders from the government and private sector discussed the need to advance digital health in the Philippines, highlighting how public and private institutions can work collectively towards this goal. DOH Director IV for Knowledge Management and Information Technology Service Dr. Enrique Tayag offered an overview of the future of the country’s health system, including a glimpse into DOH’s efforts in promoting mHealth as a powerful tool to help disseminate relevant health information and guidelines to the public, especially as part of COVID-19 response efforts.

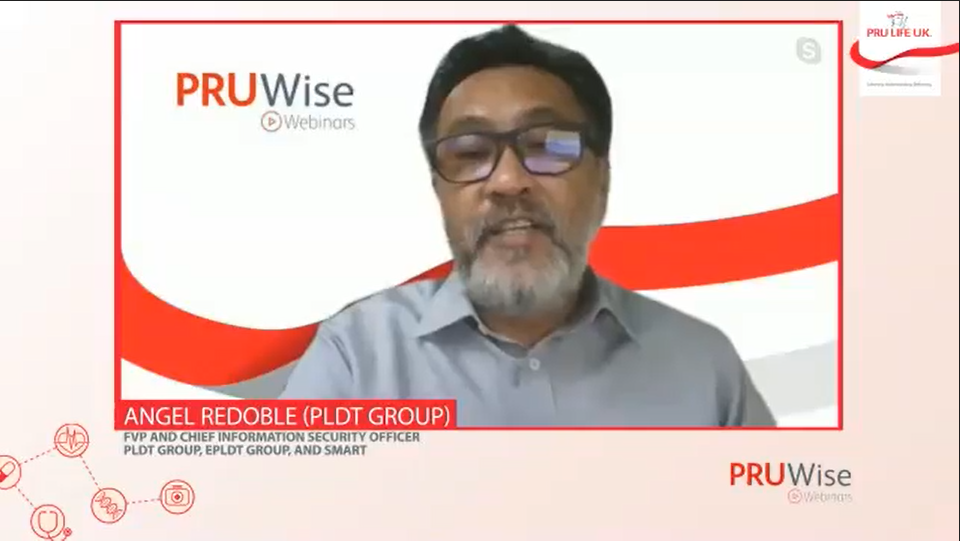

First Vice President and Chief Information Security Officer Angel Redoble of PLDT Group, ePLDT and Smart discussed how the telecommunications industry can supplement digital health efforts with technology infrastructure and safeguarding user data. He shared his views on the readiness of Filipinos in using mHealth tools now that the National ID System is almost in place. He also expressed his thoughts on how the telecommunications industry can work closely with the health and life insurance sectors to leverage mHealth to reach more Filipinos nationwide and strengthen the Philippine mobile healthcare system.

“As we conclude this pioneering and informative discussion on mobile health with leaders from both the government and private sectors, we are excited with the ongoing developments in the Philippine healthcare system and reiterate our commitment to ensuring Filipinos’ health and wellbeing through our protect, prevent, and postpone proposition,” Pru Life UK Senior Vice President and Chief Customer Marketing Officer Allan Tumbaga shared.

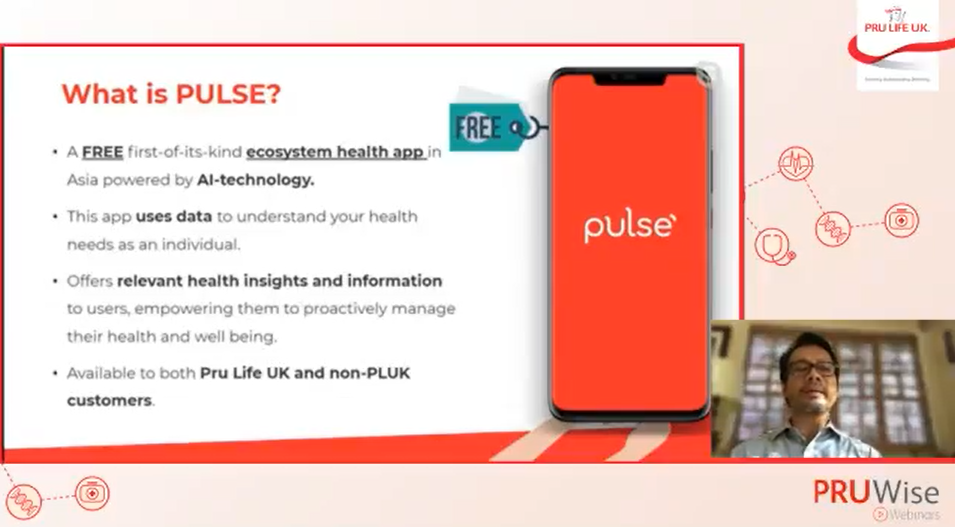

In November 2019, Pru Life UK commissioned advisory firm Quisumbing Torres to launch a whitepaper titled “Mobile Digital Health in the Philippines,” examining the readiness of the country’s regulatory environment. Soon after the study’s release, the life insurer introduced its own holistic health management app, Pulse, which allows users to proactively manage their health and lifestyle through AI-enabled tools, relevant health information and other value-added resources.

With its first PRUWise webinar on digital health, Pru Life UK is looking to expand this conversation. “We hope Healthscape PH will encourage more industries to start their advocacy for digital health. This is aligned with our commitment, through our We DO Health and We DO Innovation spirit, to promote the health and wellness of Filipinos through advanced, innovative solutions,” Tumbaga added.

For more information on PRUWise Webinars, Healthscape PH webinar, and Pulse, visit www.wedopulse.com/ph and facebook.com/prulifeukofficial.

###

About Pulse

Pulse is a digital health app and the first of its kind in the region to offer holistic health management to consumers. Using AI-powered self-help tools and real-time information, the app serves as a 24/7 health and wellness partner to users, helping them prevent, postpone, and protect against the onset of diseases. Pulse is part of Prudential’s region-wide strategy to provide affordable and accessible healthcare to everyone across Asia by leveraging digital technologies and best-in-class partnerships.

Following the regional launch of Pulse in Malaysia in August 2019, Pulse was introduced in the Philippines in February 2020. Pulse is now available in a total of 11 markets across the region, and includes a growing suite of value-add services providers such as a symptom checker, healthcheck, personal wellness services, video consultations with certified doctors and specialists.

Since its launch, Pulse has been downloaded 7 million times in Asia to date. Pulse is currently available for free on the Apple/Google Play stores in Cambodia, Hong Kong, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Taiwan, Thailand and Vietnam.

Pulse is owned and operated by Prudential Services Asia Sdn Bhd, an affiliate of Pru Life UK. Existing health services on the Pulse app are provided by third-party partners, and not Prudential.

For more information: https://wedopulse.com/ph/