How to manage your risks when investing in the stock market

by COL Financial-Philippines

Have you heard about investing but are afraid to jump in because it seems risky? Getting into something you don’t know can indeed be scary and risky. However, there are ways to grow your money in the stock market while still managing your risks. Find out how in this article.

While investing in stocks is one of the best ways to grow your money, many Filipinos are hesitant to invest in stocks because they’re afraid of the risks that come with it.

The good news is there are ways for you to take advantage of the high returns from stocks while still managing your risks so that you can invest comfortably and not lose sleep over it.

Check out these few tips:

1. Invest for the long term.

If you’re new to stock investing, you can start by setting a longer time horizon as investing for the short term may pose higher potential losses, especially if you’re not yet familiar with investing or trading strategies.

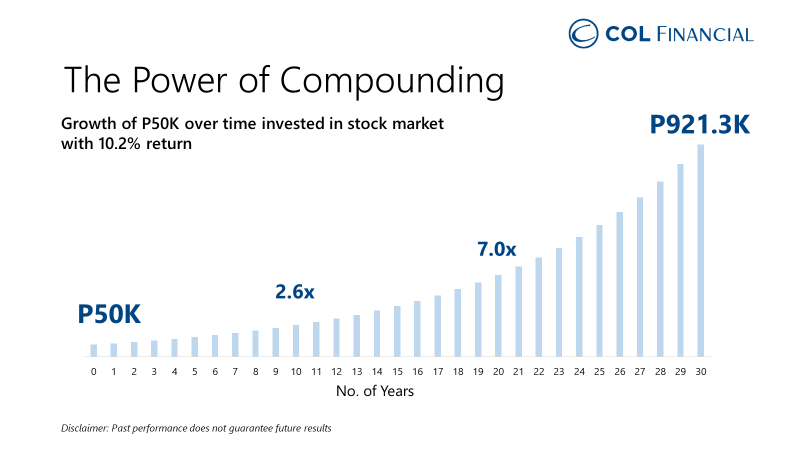

Studies show that staying invested for longer periods of time can help reduce your losses. If you’re starting out young, having a time horizon of 20 years and over can give you higher positive returns than what you can get by investing in a shorter period of time. This is especially helpful if you are building your retirement fund.

Source: COL Financial

If you are a parent, on the other hand, you can set aside the monetary gifts that your kids receive on their birthdays or during the Christmas season and invest them on their behalf. Then when they get older, you can gift them the funds that you invested as a way to help them start to become more independent and responsible financially.

However, if you’re the type who is very careful about managing their risks and prefer a shorter term period for investing, only use money you will not be needing immediately to protect your capital and peace of mind.

2. Diversify.

You’ve heard it before: “Don’t put your eggs in one basket.” This very well applies to managing your risks when investing in the stock market too.

Spread out your investments across different asset classes, sectors, exposure, or even time horizon. You can start by investing in two or three stocks that belong to different industries.

Another simple way to start is by investing in funds, where a professional fund manager takes care of choosing which stocks are best to buy depending on the fund’s objective. If you’re starting out by investing only a few thousand pesos first, investing in funds can already give you a diversified portfolio that fits your budget.

3. Be careful about buying stocks based on tips.

Go to YouTube, TikTok, or Facebook and you will find various gurus sharing stock market tips and recommendations. It's easy to get influenced into buying speculative stocks they recommend, especially when they hype you into thinking that the stock's story is positive and likely to go up quickly—well, don't be fooled.

Don’t immediately jump into it and be very discerning about following their tips. Yes, some stocks do go up quickly, but they can also go down just as fast. When this happens, you can end up getting stuck or selling at a loss as you take your chances with other investors who want to sell the stock as well.

4. Avoid borrowing money to invest.

One of the popular strategies to enhance your returns when investing is to borrow money either through a margin loan for stocks or through leverage for forex and commodities.

While there is potential to increase your returns, it can also increase your losses when prices go down. Not only that, but buying stocks using borrowed money also increases the risk of losing all your capital—making it harder for you to recover.

Ready to take the next steps?

-

Learn more about getting started investing and understand the investment options available for you by attending our free COL events

-

Start investing with your COL account as soon as you can so you have more time to grow your money

-

Continue to do your research and understand the risks before investing in stocks and funds. You can also take advantage of the guidance and research available in your COL account.

COL Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views and opinions of Pru Life UK.

About Col Financial

COL Financial is the Philippines’ leading online stockbroker, offering stocks, local funds, and global funds at www.colfinancial.com. COL is trusted by more than half a million customers, and has reached hundreds of thousands of Filipinos in its advocacy of increasing financial literacy. To start investing with COL as your wealth-building partner, go to signup.colfinancial.com today.

About Pru Life UK Investments

Pru Life UK Investments, registered as Pru Life UK Asset Management and Trust Corporation, is a subsidiary of Pru Life UK, the pioneer and current market leader of ‘insuravest’ or investment-linked life insurance in the Philippines.

Incorporated in 2018, Pru Life UK Investments offers a superior selection of funds that specifically cater to long-term savings requirements of Filipinos who want to achieve their financial goals through pure investments. These funds are managed by some of the country’s top fund managers.